Sep 30, 2022 3:16:58 PM

Weekly Market Wrap 30/09/2022

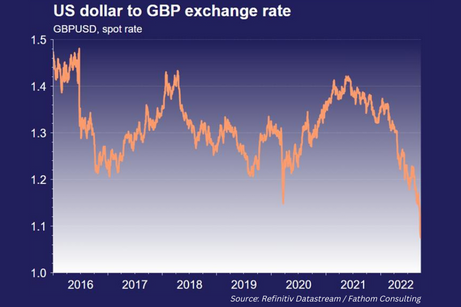

Sterling has fallen to a record low against the dollar and UK government bond yields reach their highest level in over 10 years as markets reacted to the government’s mini budget. European inflation provided an upside surprise, reaching another record high. The European energy crisis faces further challenges after Nord Stream 1 & 2 both suffered mysterious leaks. Russia announced plans to annex four regions of Ukraine after supposed referendums took place earlier in the week, a move that has been condemned worldwide.

US Markets

The S&P 500 is currently ending the week down 1.47% at 3,640 and the NASDAQ is down 1.17% at 11,180.

A number of Federal Reserve policymakers hinted at even more aggressive interest rate moves than were laid out in Chairman Powell’s recent speech. One Fed official stated that they were “comfortable” with raising rates as high as 4.5%-5% in 2023 and keeping rates at this level until at least 2024. The US government has pledged to continue supplying Ukraine with weapons and has openly criticized Russia’s plan to annex certain regions of Ukraine.

Data released on Friday showed the core personal consumption expenditures price index increased by 0.6% in August, slightly ahead of 0.5% expectations. After being unchanged in July, this data does not follow the path some investors had hoped for of seeing inflation measures continue to decline.

UK Market

The UK market ended the week lower, despite global criticism of the government’s recent changes to economic policy and the potential effect this could have on the outlook for the UK. Both the IMF and rating agency Moody’s openly questioned the policy choices of the new government, concerned that recent tax cuts could add stimulus to the economy and cause inflation to worsen. The expectation of an increase in government borrowing pushed the pound to a record low against the US dollar, briefly reaching $1.03.

The BoE’s Chief Economist Huw Pill told markets that the central bank was likely to deliver a “significant response”, with many expecting an interest rate increase of at least 100bp at the bank’s November meeting. UK GDP unexpectedly grew in Q2 of 2022, showing an increase of 0.2% rather than the expected 0.1% fall. However, the UK economy remains below its pre-pandemic peak, confirming the slowest recovery of any nation in the G7. Prime Minister Liz Truss and Chancellor Kwasi Kwarteng met with the chair of the Office for Budget Responsibility on Friday to discuss recent changes, however have left the government’s medium term fiscal plan unchanged and have refused to publish an early economic forecast.

European Markets

The Euro Stoxx 50 is currently down 0.32% to 3,324, the DAX is down 1.72% at 12,073 whilst the CAC 40 lost 0.97%, reaching 5,730. European inflation measures heaped further pressure on the ECB this week, as Eurozone inflation showed a record 10% YoY increase (9.7% est), whilst German CPI came in at 10.9%, significantly ahead of the 10% estimate. The ECB is now fully expected to hike interest rates by at least 75bps at the bank’s October meeting, with a 100bps increase also a possibility. The European energy crisis took an unexpected turn after the Nord Stream 1 & 2 pipelines began leaking, further reducing the amount of gas provided to Europe. The continuation of rising gas prices could accelerate European inflation and cause the potential recession to have a larger impact or occur sooner than previously expected.

The Italian election yielded a majority for the centre-right coalition, which could bring much needed political stability to the country after years of many poor and short-lived coalitions. The Italian market opened more than 1% higher on Monday morning as the economy responded positively to the news.

Fixed Income

Yields on the US 10-Year rose by 5bps to 3.74%, after reaching more than 4% earlier this week as a number of US policy makers reaffirmed that rates are likely to exceed 4% in the near future.

UK 10-Year yields continued to push higher after the UK’s mini budget, jumping by 31bps to 4.11% despite Bank of England buying gilts to support pension funds.

Commodities

Brent Crude gained 2.47% this week, on the hopes that OPEC+ may agree a cut in output at next week’s meeting.

The Week Ahead

Monday – US Manufacturing PMI

Tuesday – RBA Interest Rate Decision

Wednesday – US Employment Change

Thursday – Eurozone Retail Sales

Friday – US Non-Farm Payrolls

*Price changes as of last week’s close unless stated otherwise.