Mar 24, 2023 11:17:19 AM

Weekly Market Wrap 24/03/2023

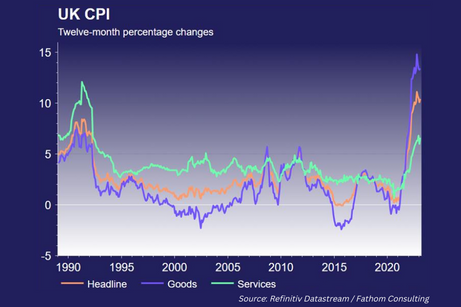

The end of central bank rate hikes are now firmly on the horizon as concerns about the health of the banking system continue. UK inflation significantly surprised to the upside as the US Fed and Bank of England raised interest rates by 0.25% despite the risks to the banking sector.

UK Market

The UK market ended the week flat. UK inflation offered a significant upside surprise this week, rising to 10.4% from 10.1% in January whilst a decrease to 9.9% was expected. The unexpected increase in CPI was mainly driven by significantly higher food and drink prices, whilst costs of fuel and transport eased over the month. The lack of another drop in inflation forced the Bank of England to continue raising interest rates, whereas before the CPI release markets were split between a 0.25% increase of no increase at all due to significant pressure of the banking sector. On Thursday the BoE delivered a 0.25% increase as expected, taking the UK base rate to 4.25%. Governor Andrew Bailey reiterated that inflation in the UK is expected to fall rapidly this year, despite February’s surprise figure. Economists are now split over whether or not the BoE will raise rates any further, or if the bank has reached the peak of its tightening cycle. UK retail sales surprised to the upside on Friday, increasing by 1.2% from January as consumers increased spending in supermarkets and discount retailers and cut back on takeaways or meals out.

US Markets

The S&P 500 is currently ending the week up 0.82% at 3,948 and the NASDAQ is 1.7% higher at 12,729. The Federal Reserve raised interest rates by 0.25% on Wednesday, taking rates up to the 4.75-5.00% range, however there was a dovish tone in the accompanying commentary. Fed officials expect rates to reach 5.10% by the end of 2023 and then to gradually fall lower throughout 2024 and 2025, however markets are currently pricing in rate cuts to occur before the end of the year. The expectations by investors for rate cut comes from the view that higher rates will put significant pressure on economic growth and will cause unemployment to rise in the US. US initial jobless claims unexpectedly fell this week, dropping to 191k when 197k had been forecast, reinforcing the view that the US labor market remains strong.

European Markets

The Euro Stoxx 50 is currently up 1.17% at 4,112, the DAX is 0.71% higher at 14,870, whilst the CAC 40 has gained 0.77% to 6,979. Eurozone business activity comfortably beat expectations (54.1 vs. e.51.9) as consumer spending on services was very strong; weakening demand for manufactured goods suggested issues in the factory sector. The European banking sector is under pressure as UBS and Deutsche Bank continued their descent on Friday, both losing a fifth of their value in March and CDS for the Banks are today rising markedly. Developments at Credit Suisse and turmoil among regional U.S. banks fuelled concerns about the health of the global banking sector. The ECB confirmed it would no longer provide guidance and instead decide meeting-by-meeting, as global central banks appear to have reached the end of their interest rate hiking cycle for now.

Fixed Income

Yields on 2-Year US government bonds fell sharply again to 3.58% this week, longer term benchmark 10-year treasury yield fell by more muted 10 basis points to 3.30%; accelerating the yield inversion. Europe and the UK followed suit, albeit to a lesser degree as the banking crisis adjusted expectations globally.

Commodities

Brent Crude gained by 2.90% this week, reaching $75 per barrel, as strong commodity demand in China helped put a stop to recent falls in the price of oil which were driven by recessionary fears.

The Week Ahead

Monday – Andrew Bailey Speech

Tuesday – US Consumer Confidence

Wednesday –

Thursday – US GDP & US Initial Jobless Claims

Friday – UK GDP & European CPI

*Price changes as of last week’s close unless stated otherwise.