Sep 9, 2022 3:27:02 PM

Government Bond Market Turmoil

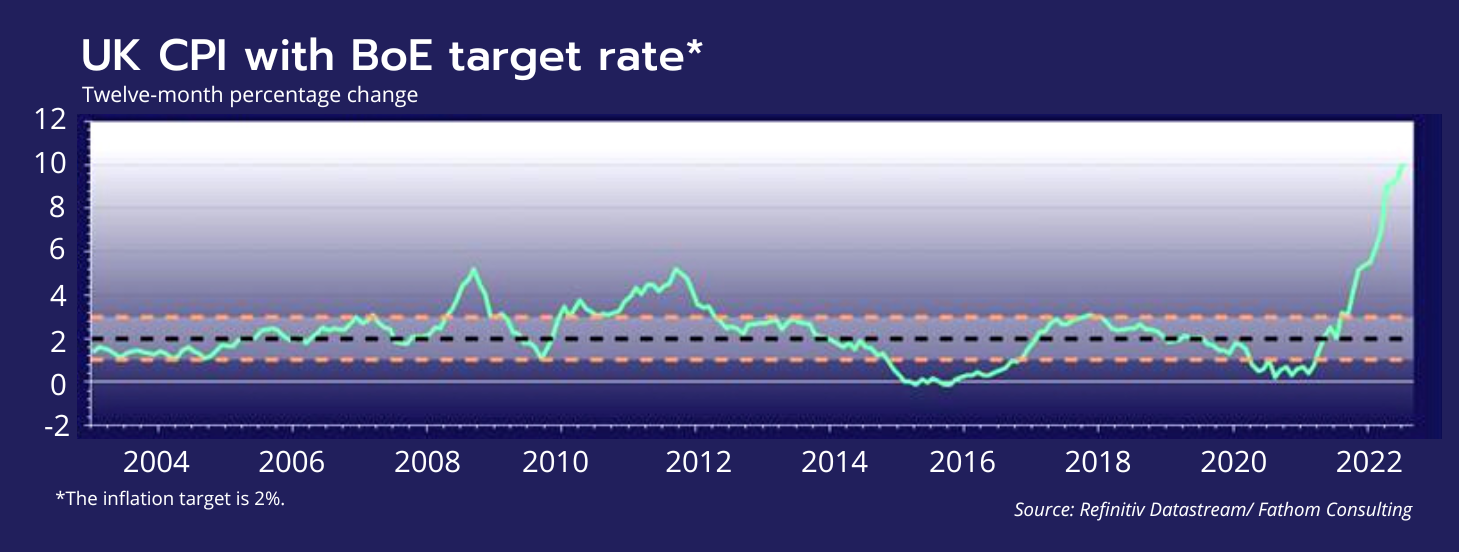

Central Bank action has dominated financial markets throughout 2022, as inflation across the globe has reached the highest levels seen in decades. Russia’s invasion of Ukraine has triggered numerous shortages, supply chain issues and the potential for a full-scale energy crisis in Europe. The UK has been no exception to the surge in inflation, with August’s CPI figure delivering the UK’s highest reading in 40 years at 10.1%, well above the Bank of England’s target of 2% annual inflation.

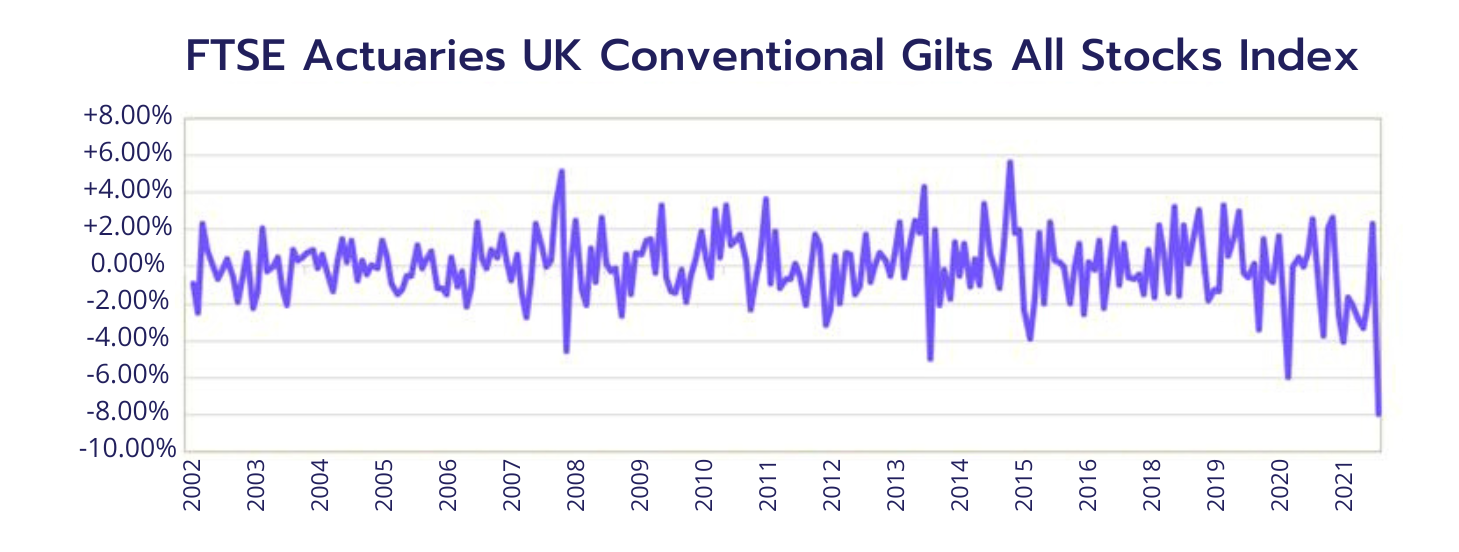

The Bank of England raised interest rates by 0.50% in August taking rates to 1.75%, the largest increase in 27 years and simultaneously issued estimates that UK inflation could reach 13% by the end of 2022. Future rate expectations were boosted further after Bank of England Governor Andrew Bailey stated that “The Monetary Policy Committee will take the actions necessary to return inflation to the 2% target”. These comments sparked a rapid rise in short term yield estimates for Gilts, pushing UK bond prices lower.

Another key event from August was the Jackson Hole symposium, an annual meeting of global central bank officials. Despite potential recessionary concerns, central bank policy makers presented a united front, and clearly told investors that interest rates at the world’s major central banks would continue to rise in order to bring down inflation, regardless of whether or not this caused a slowdown in underlying economic activities. The clear statement that rates would continue to rise in the coming months provided a further shock to bond markets, with surging yield expectations pushing prices down once again.

The mixture of the Bank of England’s dramatic increase in its inflation forecast, Governor Bailey’s comments and the sentiment presented by speakers at the Jackson Hole Symposium resulted in a 7.92% fall in the total return of UK Government bonds. The largest moves were seen on Gilts with a maturity date greater than 5 years, with shorter dated Gilts suffering less.

Looking forward, the delayed Monetary Policy Committee meeting on 22nd September is expected to deliver a further 0.50% rate increase. However, beyond this meeting, data will drive the future of interest rates. UK CPI will need to begin showing signs of slowing in order to stop the Bank of England’s current path towards higher rates. An element of political uncertainty also hangs over the future of Gilts, as new Prime Minister Liz Truss begins to lay out plans for increased government spending, which could be funded by increased levels of government debt.