Jan 27, 2023 3:37:52 PM

Weekly Market Wrap 27/01/2023

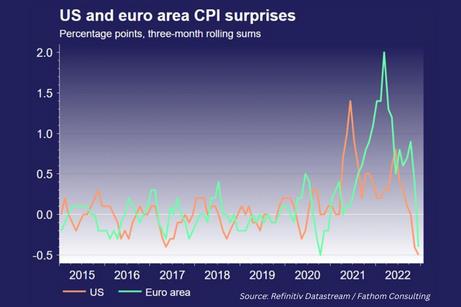

Global equities returned to their positive start to the year, despite a number of cautionary statements from key companies so far in earnings season. Towards the end of the week, investors turned their eyes to next week as major central banks including the U.S. Fed, the European Central Bank, and the Bank of England (BoE) will announce monetary policy decisions. The market is pricing in a Fed pivot as recent inflationary data in the US has been soft. After consistently surprising to the upside in 2021 and the first half of 2022, recent surprises have been negative.

UK Market

The UK market ended the week higher, as UK retail sales unexpectedly fell 1% in December. Economists had expected a 0.5% increase and retail sales now stand 1.7% below their pre-covid levels. UK Chancellor Jeremy Hunt has reiterated that lowering inflation is seen as more important than immediate tax reductions claiming that “the best tax cut right now is a cut in inflation”. Expectations are for a 50-basis-point rate hike from the BoE next week, taking the BoE base rate to 4.00%.

US Markets

The S&P 500 is currently ending the week up 2.00% at 4,052 and the NASDAQ is down 3.55% at 12,031. Data released on Thursday showed that the US economy grew faster than expected (2.9% vs 2.6%e.) in Q4 of 2022, however the underlying data did not paint such a positive picture. Despite solid spending early on in Q4, retail sales fell sharply in November and December, whilst business spending also fell. Markets are now looking ahead to the Federal Reserve’s statement and rate decision next week, where it is widely expected that rates will rise to the range of 4.5-4.75%. This would represent a clear slowdown in the pace of rate hikes, as inflation continues to clearly fall back towards the central bank’s target rate. US consumer spending fell in December, reinforcing the case that inflation is rapidly slowing and that it may be appropriate for the Fed to continue slowing the pace of its hikes.

European Markets

The Euro Stoxx 50 is currently down 0.38%% at 3,853, the DAX is 0.50% higher at 15,107 whilst the CAC 40 has fallen 1.20% to 7,079. The conflict between Russia and Ukraine shows no signs of an end, as fighting intensifies after a number of key allies, including the US and Germany agreed to supply Ukraine with tanks. President Zelenskyy called for further harsh sanctions on Russia, as well as for more weapons from allies as the war nears a year. The ECB is highly expected to raise interest rates by 50bps to 2.50% next week, with Eurozone inflation still above 9%.

Fixed Income

Yields on the US 10-Year were flat across the week at 3.48%, ahead of the Federal Reserve’s announcement next week where further clues on the Fed’s policy path will be revealed.

Commodities

Brent Crude rose 0.80% this week to $88 per barrel, as better than expected US economic data boosted demand hopes.

The Week Ahead

Monday – European Consumer Confidence

Tuesday – European GDP

Wednesday – European CPI, Fed Rate Decision

Thursday – BoE Rate Decision, ECB Rate Decision

Friday – US Nonfarm Payrolls

*Price changes as of last week’s close unless stated otherwise.