Aug 19, 2022 3:25:53 PM

Weekly Market Wrap 19/08/2022

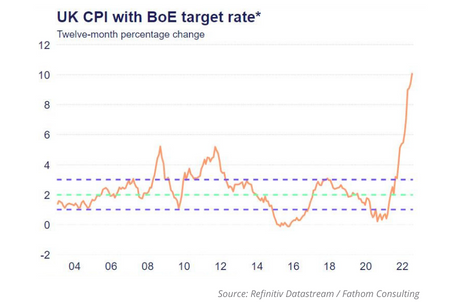

UK CPI reached double digits this week, as increased food costs were the key driver behind the UK hitting a 40-year high for inflation. Meanwhile, UK consumer confidence reached its lowest since records began, as the cost-of-living crisis looks set to only worsen for the UK public. FOMC minutes were released this week, which gave investors a better idea of the path that the Fed may follow in the coming months when looking to raise rates. China’s central bank cut its lending rate earlier this week after data showed that the Chinese economy had slowed during July. Industrial output and retail sales for China both came in below expectations and showed a slowdown from the June which triggered cuts of the PBOC’s two key lending rates by 10 basis points each.

US Markets

The S&P 500 is currently ending the week down 0.60% at 4,254 and the NASDAQ is down 1.65% at 13,339. FOMC minutes released this week indicated that in the short term, the Federal Reserve looks set to continue raising rates into “restrictive territory” as it seeks to reduce inflationary pressures on consumers. Whilst the Fed suggested that the pace of future rate hikes would be dependent on economic data points, a number of Fed officials have made hawkish statements since the minutes were released. This included backing a 75-basis point hike in September and the potential of rates reaching 4.00% by the end of 2022. The market is currently pricing in a 50-basis point hike for the September meeting.

UK Market

The UK market ended the week positive. UK CPI came in at 10.1% for July on Wednesday, the highest level in 40 years and significantly above economist estimates of 9.8%. This data pushed further pressure onto UK consumers, with a survey on Friday showing that UK household sentiment is at its lowest level since records began in 1974. Rising food, fuel, and energy prices have significantly dampened the outlook for UK consumers, as well as the upcoming announcement of the new Prime Minister and the energy price cap rise to come later this year all placing downward pressure on discretionary spending. Markets are now pricing in another 50 basis point rate hike at the Bank of England’s September meeting, with the central bank recently projecting inflation to exceed 13% before the end of 2022.

European Markets

The Euro Stoxx 50 fell 0.85% to 3,774, the DAX was down 1.54% at 13,596 whilst the CAC 40 lost 0.54%, reaching 6,518. German producer prices rose at the fastest pace ever recorded in July, increasing by 5.3% month-on-month. Prolonged supply chain disruption, rapidly increasing energy costs and the war in Ukraine were the key contributors to rising prices. This data comes after the German economy did not grow in Q2 and the news that the German government will impose levies from October that will drastically increase energy bills. The gloomy outlook for Europe’s biggest economy has reignited fears of a recession in Europe.

Fixed Income

Yields on the US 10-Year Treasury rose slightly to 2.88%, as expectations for the Fed’s future rate hikes were reaffirmed by the FOMC minutes.

Commodities

Brent Crude fell 3.30% this week as concerns around a global recession pushed demand expectations lower.

The Week Ahead

Monday – China Interest Rate Decision

Tuesday – EU Consumer Confidence

Wednesday – US Capital Goods Orders

Thursday – US GDP, Initial Jobless Claims

Friday – Jackson Hole Symposium

*Price changes as of last week’s close unless stated otherwise.