May 5, 2023 1:23:54 PM

Weekly Market Wrap 05/05/2023

The Federal Reserve looks to signal a pause in interest rate increases, however the ECB warns that the fight against inflation is far from over. Higher rates appear to be taking their toll on both the US and European economies whilst the threat of a US government default as early as June persists.

UK Market

The UK market ended the week lower. The conservatives face steep losses in UK local elections as voters turn against the party following a chaotic year. The Bank of England is expected to deliver a further 0.25% rate increase at next week’s meeting, taking the UK base rate to 4.50% after CPI and RPI data released in April showed no indication of slowing inflation. Unlike in the US, markets are pricing in further hikes for the UK, with rates currently expected to go as high as 5.00%.

US Markets

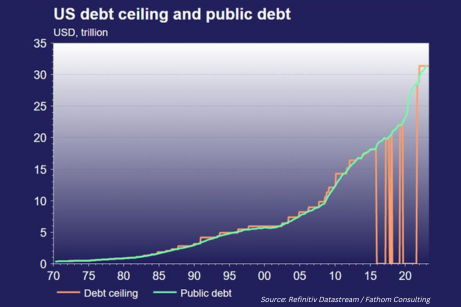

The S&P 500 is set to end the week down 2.60% at 4,061 and the NASDAQ is 1.99% lower at 12,982. US markets continue to monitor developments around the government’s debt ceiling, with a note from Treasury Secretary Yellen warning that the government could default on payment obligations as early as June 1st if an agreement isn’t reached. The Federal Reserve raised interest rates by 0.25% as expected, taking US interest rates to the 5.00-5.25% range. Fed Chairman Jerome Powell signaled that this may be the final hike in this rapid cycle that has seen rates increase by 500bps, with markets currently pricing in no further increases and leaning towards a rate cut in September. The US jobs market is expected to have softened in April, as employers begin to feel the affects of higher interest rates and rising costs. Non-Farm payrolls are expected to fall to 180k from the previous figure of 236k, whilst the unemployment rate is expected to rise slightly to 3.6% from 3.5%.

European Markets

The Euro Stoxx 50 is currently down 1.02% at 4,007, the DAX is 0.36% lower at 15,864, whilst the CAC 40 has fallen 1.44% to 7,383. This week the European Central Bank raised rates by 0.25% as expected, taking the deposit rate to 3.25% and the refinancing rate to 3.75%. ECB President Christine Lagarde made it clear that there was still work to be done on the bank’s fight against inflation, telling markets “We have more ground to cover and we are not pausing, that is extremely clear.”

German industrial orders fell by significantly more than expected, decreasing by 10.7% on the previous month when economists had predicted a 2.2% decrease. Eurozone retail sales also fell more than expected, dropping by 1.2% MoM, whilst a 0.1% decline had been forecast. Germany contributed the largest decline, with a fall of 2.4%.

Fixed Income

Yields on 10-Year US government fell slightly to 3.37% as the Federal Reserve raised interest rates as expected and signalled a pause in its 14-month tightening cycle, as policymakers balance the need to slow inflation against a pressing set of risks, ranging from bank failures to the possibility of a U.S. debt default as soon as next month.

Commodities

Brent Crude is set to fall 7.34% this week, pulled lower by anticipation of a fall in Chinese demand after the latest services PMI showed a slight decrease in momentum. The US banking crisis is pushing gold close to an all-time high at 2,035, the commodity is up 12% YTD.

The Week Ahead

Monday – Bank Holiday

Tuesday – China Trade Balance

Wednesday – US CPI

Thursday – BoE Rate Decision, US Initial Jobless Claims

Friday – UK GDP

*Price changes as of last week’s close unless stated otherwise.