Nov 27, 2023 2:14:58 PM

Our Model Portfolios are 2-years old!

“Oh, the grand old Duke of York…”

We’ve had two years managing the Model Portfolio range at O-IM and the dominant theme driving markets thus far has been the dramatic rise (and fall) of inflation. We’re currently half-way up across the developed world and looking forward it would be preferable to neither be particularly up nor down for a while…

(apologies the metaphors are usually a bit more erudite, but as a father of two young children that’s all we’ve got for now…)

Our positioning and approach ensured we avoided the worst of the falls across the range in 2022 and we are pleased that during 2023 the portfolios have indeed showed their worth. We also take the opportunity to look ahead across the portfolio range. I have used our level four medium-risk portfolio as a baseline for discussion – our higher/lower risk portfolios tilt benchmark positioning on a strategic and tactical basis so the same thematic discussions are relevant across the MPS range.

A difficult period for GARP, and for the markets in general

2022 was a year most investors would like to forget. Following the pandemic boom, consistent government support and uninterrupted central bank monetary policy, inflation became a very sticky problem made worse by Russia’s invasion of Ukraine. Major indices ended 2022 in the red, with a relative bright spot for the FTSE 100 thanks to its energy, commodity, and consumer staples weighting.

The portfolio was down 10.17% against the benchmark’s -7.35% across the first calendar year of the MPS, with the relative underperformance driven by the portfolio’s overweight allocation to small cap equities as well as positions in US large-cap technology stocks. These holdings suffered unduly as global inflation continued to push higher and expectations for how high central banks would raise rates soared well beyond market expectations. The portfolio did however escape the worst of the losses seen in bond markets as we kept our fixed income allocation significantly underweight and our duration low.

In 2023 central banks continued to hike rates aggressively in response to inflation; structurally altering the value of global assets across. Long-dated fixed income was particularly affected, allowing the portfolio to benefit from its continued underweight position in long-term bonds. Equity markets have performed well throughout the year; the portfolio is currently up 9.01% TYD vs. the benchmark’s 3.98%, for second twelve months the corresponding figures are 6.87%, comfortably outpacing the benchmark’s 2.56%.

Overall, the portfolio has beaten the benchmark by 1.04% (-4.12% vs. -5.16%), which is particularly pleasing given that it has been a difficult period for GARP, and the markets in general.

It has been some of the least conducive market environments in my investing career across the last two years, and despite the underlying volatility in global markets our approach has been consistent.

Portfolio positioning

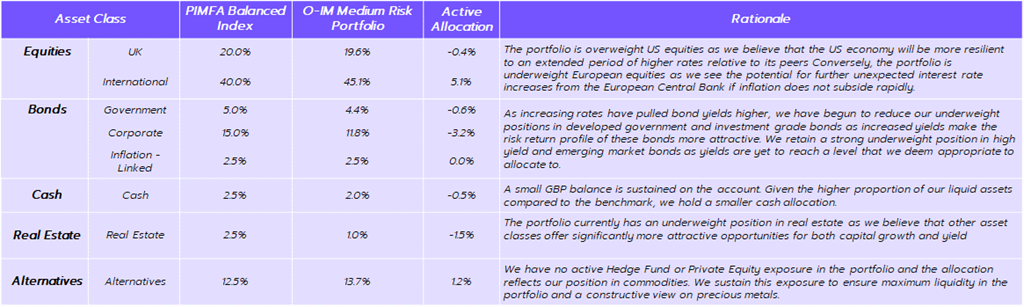

The headline positioning against benchmark each month contains some of our ideas and positioning but hides some of more interesting things “under the bonnet”.

Although we are currently overweight international equities and have an underweight position to the UK, this hasn’t always been the case. We were positioned well last year on a global allocation basis as our UK allocation benefitted from the FTSE’s relative outperformance (banks, energy & general value being a key driver of that). As the relative cheapness faded for UK stocks in general, we both reduced our allocation to the UK on a macro basis and saw fewer opportunities to buy quality companies at reasonable prices from our individual stock selection. Conversely, in the US, the tech led sell-off on the back of inflation and rate concerns has led to some particularly attractive opportunities across the period. Notably Meta which we were able to pick up at comfortably less than half of where it is currently traded and has proved to be our best performing stock YTD.

Across fixed income we began the MPS about as relatively short as you can be across the board – there just wasn’t any attractive opportunities. High-quality government bonds were negative yielding and the chase for yield had let some extremely speculative junk bonds offering next to nothing in terms of return. We are much closer to a benchmark weighting across the board for obvious reasons, but we are a little cautious on corporate bonds as the risk premium isn’t quite there vs. government securities. Until very recently we had solely very short duration notes in our portfolios (a negatively sloped yield curve gives me very little comfort in taking undue duration risk) although we do believe that the rate hiking cycle is drawing to a close and have brought duration closer to market as of our latest portfolio rebalance.

In the alternatives space we have absolutely no hedge fund or PE exposure and almost certainly never will – we balance the risk in our portfolios via commodity ETFs.

Stock example

To give a flavour of our investment process in individual equities I would like to take the opportunity to highlight Volex, which we believe highlights our GARP approach in individual equities.

Volex is one of the most exciting boring companies you’ve never heard of – they make cables. Despite not sounding like the most interesting company in the world, Volex is in a prime position to benefit from several structural growth trends (electric cars, global healthcare and digitization) and, unlike the obvious beneficiaries of these trends, the company is reasonably priced at 11 x earnings.

Looking ahead we believe the portfolios are well positioned to perform well over the medium to long term. we don’t look to speculate in short term market movements; rather to invest in long-term quality investment opportunities that we believe in. On to year three!

All the best,

Matthew Hull, CFA.