Jul 21, 2023 3:00:45 PM

Weekly Market Wrap 21/07/2023

UK inflation data surprised markets once again this week, whilst retail sales and consumer confidence data paint contrasting pictures for the UK. Concerns about China’s weak economic recovery and weakness in the technology sector amid the earnings season capped equity market gains.

Investors are now focused on another round of major central bank policy meetings next week for more clues on the global interest rate trajectory.

UK Market

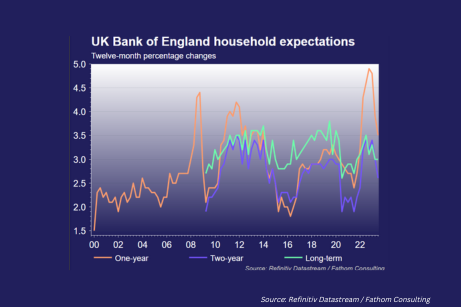

The UK market ended the week higher. UK inflation data offered a rare downside surprise this week, with both core and headline CPI coming in below consensus forecasts. Headline CPI slowed to 7.9% in June from 8.7%, the lowest level seen since March 2022. Economists had expected a reading of 8.2%, however a 23% decrease in fuel prices drove headline inflation lower. Core CPI was expected to be flat for the month of June at 7.1%, however unexpectedly fell to 6.9%. The stronger than expected reduction in inflation will be welcomed by the Bank of England, who have been heavily criticised for the affects that persistent rate hikes could have on the UK economy. Markets are still pricing in a 25bps rate increase at the BoE’s August meeting, whilst the estimated terminal rate for the UK is at 6.00%. UK retail sales released on Friday also offered an upside surprise, with sales growing 0.7% MoM, when an increase of just 0.2% was expected. Unusually hot weather and an additional bank holiday boosted sales throughout the period. Consumer confidence fell for the first time in 6 months, as the prospect of prolonged periods of higher rates and continued inflation above the 2% target cause concern for consumers.

US Markets

The S&P 500 is set to end the week up 2.25% at 4,510 and the NASDAQ is up 3.56% at 15,571. The US economic picture continued to improve as forecasters that initially predicted a US recession are starting to hedge their bets as inflation ebbs and the economy remains resilient. All eyes turn to the Fed meeting next week.

European Markets

The Euro Stoxx 50 is currently up 3.84% at 4,399, the DAX is 3.14% higher at 16,093, whilst the CAC 40 has gained 3.94% to 7,392. European tech bellwether SAP impacted market sentiment following a downbeat forecast. A diplomatic spat between Sweden and Iraq hit the headlines whilst wildfires hit Greece as a major heatwave hit the continent.

Fixed Income

Yields on 10-Year US government bonds were flat this week at 3.84%, ahead of the Fed’s interest rate decision next week where at 25bps hike is expected.

Commodities

Brent Crude is currently up 0.91% and natural gas is up 9.29% on the week as Russia threatened quotas on fuel exports and hit Ukrainian food export facilities across the week and practiced seizing ships in the Black Sea in what is widely seen as an effort to avoid sanctions by threatening a global food crisis.

The Week Ahead

Monday – UK Manufacturing PMI

Tuesday – US Consumer Confidence

Wednesday – Fed Interest Rate Decision

Thursday – ECB Rate Decision, US GDP

Friday – Germany CPI

*x% up/down to price as of last week’s close