Nov 11, 2022 12:24:17 PM

Weekly Market Wrap 11/11/2022

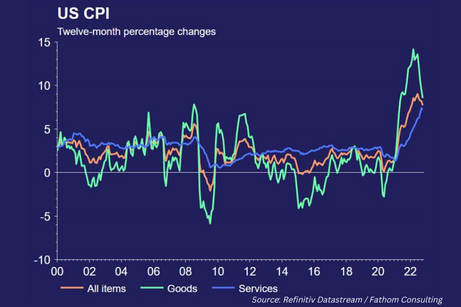

Some welcome respite as markets reacted extremely positively as U.S. inflation appeared to be turning the corner as consumer prices rose comfortably below expectations, 7.7% YoY, and weekly jobless claims increased 7,000 to 225,000. This is the strongest sign yet that inflation is slowing, which would allow the Federal Reserve to scale back its hefty interest rate hikes.

Markets reacted positively as China eased COVID rules on Friday, shortening quarantine times among other incremental measures.

A long recession looms in the UK however as third quarter GDP fell by 0.2%. The UK remains beset by substantial long-term supply-side damage from Covid and Brexit, and more intense headwinds from fiscal and monetary policy.

UK Market

The UK market ended the week flat. Data released on Friday showed that UK output fell by 0.2% in Q3 of 2022, a smaller contraction than the estimated 0.5%. Despite a smaller than expected move, the UK is still expected to enter into a long recession, with the Bank of England last week predicting that the recession will be the longest since records began, lasting well into 2024. This news comes ahead of next week’s budget where Jeremy Hunt is expected to announce increases in tax and cuts to spending as the UK looks to restore stability to its economy. Investors are also looking ahead to UK inflation data next Wednesday, where inflation is expected to increase to 10.8% YoY, from a previous figure of 10.1%. Markets currently expected to BoE to raise rates by a further 50bps in December, however an upside surprise with inflation could lead to an even larger move by the MPC.

US Markets

The S&P 500 is currently ending the week up 4.93% at 3,956 and the NASDAQ up 6.10% at 11,114 US markets rallied on Thursday, recording their strongest one day move in more than two years after US CPI data came in below expectations. The S&P gained more than 5% whilst the Nasdaq rallied 7% as CPI for October fell to 7.7%, below the consensus estimate of 8.0%. The lower than expected figure has given further momentum to the idea that US inflation has peaked and is now heading towards more manageable levels. Markets are now pricing in a 50bp rate increase in December, as the Fed begins to slow the pace of rate hikes. US midterm elections took place this week, markets had anticipated a “red wave” with Republicans expected to take majorities in both the house and the senate. However, results were closer than expected and crucial results are yet to be confirmed, currently the race for the senate is extremely close, whilst Republicans look to be heading for a majority in the house of representatives.

European Markets

The Euro Stoxx 50 is currently up 2.04% to 3,669, the DAX is up 5.69% at 14,228 whilst the CAC 40 gained 2.61%, reaching 6,584. European miners and luxury good stocks rallied on Friday, spurred on by the news of China easing covid-19 restrictions. Russia announced on Friday that forces had withdrawn from the city of Kherson, whilst Ukraine reported that it had reclaimed over 40 settlements, a key shift of momentum in the war and the first time Russia have abandoned a major occupied city during this conflict.

Fixed Income

Yields on the US 10-Year fell to 3.81%, as lower than expected inflation figures lowered rate expectations for the Fed’s next meeting. Yields fell 32bps on Thursday alone, the largest one day drop in yields since 2009.

Commodities

Brent Crude fell 2.01% this week to $96.59 per barrel, despite rallying on Friday after Chinese health authorities began to ease a number of the country’s strict Covid-19 rules.

The Week Ahead

Monday – Euro Zone Industrial Production

Tuesday – China Retail Sales, Euro Zone GDP

Wednesday – UK CPI, US Retail Sales

Thursday – US Initial Jobless Claims

Friday – UK Retail Sales

*Price changes as of last week’s close unless stated otherwise.