Feb 17, 2023 10:32:30 AM

Weekly Market Wrap 17/02/2023

US inflation data released this week disappointed equity markets, whilst releases from the UK painted a more positive picture. Inflation remains a key concern for all major central banks, as markets begin looking ahead to the next set of interest rate moves. As the war in Ukraine approaches the one year mark, Russia’s invasion will be the main topic of discussion at next week’s Munich Security Conference.

UK Market

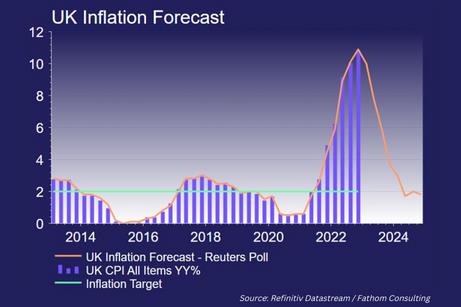

The UK market ended the week higher, as UK inflation fell by more than expected. UK CPI data fell to 10.1% in January (from 10.5% in December) below the economist estimate of 10.3%. The recent fall in inflation reinforces the Bank of England’s most recent outlook, which predicted that inflation within the UK would fall 3.0% by Q1 of 2024. The third consecutive monthly decline in CPI has begun to give the BoE confidence that higher interest rates are pushing inflation lower, as such, the pace of rate hikes is expected to slow to just 25bps in the March meeting. UK retail sales unexpectedly increased in January, as shopping in discount retailers and consumers taking advantage of special offers masked a longer trend of declining consumer spending.

US Markets

The S&P 500 is currently ending the week flat at 4,090 and the NASDAQ is up 1.12% at 12,442. US CPI surprised to the upside this week, falling from 6.5% in December to just 6.4% in January. The consensus estimates had predicted inflation would fall to 6.2%. This reading is likely to keep the Federal Reserve on the path of modest rate hikes in the coming months in order to ensure inflation continues its path back towards the 2% target. The Producer Price Index also dropped by less than expected, dropping to 5.4% in January, whilst a 4.9% reading was expected. Markets are currently pricing in a 25bps interest rate increase for March.

European Markets

The Euro Stoxx 50 is currently up 1.46% at 4,259, the DAX is 0.63% higher at 15,404 whilst the CAC 40 has gained 2.57% to 7,313. Another European Central Bank official has suggested that markets may not be fully pricing in the effects of inflation in the Eurozone. ECB board member Isabel Schnabel said that “markets are priced for perfection” and that the ECB may need to begin hiking rates at a faster pace. As Russia’s war in Ukraine reaches the one-year mark, world leaders will meet at the Munich Security Conference where much discussion about global and European security is expected to be discussed.

Fixed Income

Yields on the US 10-Year rose this week to 3.90%, after higher than expected CPI data increased US interest rate expectations.

Commodities

Brent Crude fell 3.4% this week to $83 per barrel, as expectations of higher interest rates weigh on estimates for oil demand.

The Week Ahead

Monday – China Interest Rate Decision

Tuesday – US & European Manufacturing

Wednesday – FOMC Minutes

Thursday – US GDP & Initial Jobless Claims

Friday – UK & German Consumer Confidence

*Price changes as of last week’s close unless stated otherwise.