Nov 4, 2022 3:02:18 PM

Weekly Market Wrap 04/11/2022

The Bank of England and the Federal Reserve both delivered the expected interest rate increases this week, as comments made by key central bank officials put investors on high alert. European CPI came in significantly ahead of expectations, dashing any hopes that European inflation has peaked, whilst the ECB have vowed to continue on their rate increasing path. Chinese markets and commodities rallied on Friday, on hopes that China’s economy could begin to move past the previous harsh covid-19 restrictions seen over the last two years.

UK Market

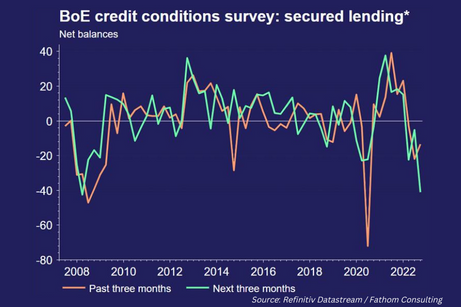

The UK market ended the week higher as the Bank of England followed its counterparts and raised interest rates by 75bps, delivering the largest rate hike in 33 years, taking UK rates to 3%. Andrew Bailey was quick to warn investors that the BoE believes that the UK has already entered a downturn, which is expected to last until 2024. Meanwhile, unemployment is expected to rise to 6.4%, from the current figure of 3.5%. Rising interest rates have pushed mortgage rates in the UK to the highest level seen in 14 years, which in turn has seen the availability of mortgages to the UK public plummet.

US Markets

The S&P 500 is currently ending the week down 2.94% at 3,786 and the NASDAQ is down 5.53% at 10,907. The Federal Reserve delivered the widely expected 75bp rate hike on Wednesday, taking interest rates to the 3.75-4% range. Many investors had hoped that Chairman Powell’s comments would hint at a slowdown in the pace of rate increases in the coming months, however Powell’s remarks left investors disappointed. Markets heard that the Fed’s Terminal Rate would be “higher than previously expected” and that “We have ways to go when it comes to raising interest rates”. The Hawkish comments caused markets to end Wednesday lower. Friday’s non-farm payrolls data surprised, as the US added 261,000 jobs in October, well ahead of the 200,000 estimated. This data was accompanied by higher than anticipated unemployment, rising to 3.7% from 3.5% in September.

European Markets

The Euro Stoxx 50 is currently up 2.69% to 3,710, the DAX is up 2.12% at 13,524 whilst the CAC 40 gained 2.99%, reaching 6,460. European CPI data came in at a record high 10.7% for October, significantly above the economist consensus of 10.2%. The latest figure keeps pressure on the ECB to continue fighting inflation with higher interest rates, markets are currently pricing in a 50bp rate hike for the ECB’s December meeting. President Christine Lagarde commented after the record figure that even a recession within the Eurozone would not stop the ECB from continuing on their path to higher rates, which are viewed as necessary to tame inflation. October PMI data for the Euro Zone came in at a 23-month low of 47.3 (any number below 50 indicates economic contraction). The result indicates declining industrial activity with the region as record high inflation and rising energy costs begin to hurt businesses.

Fixed Income

Yields on the US 10-Year rose to 4.11%, as Federal Reserve chairman Jerome Powell delivered hawkish commentary after a fourth consecutive 75bps rate hike by the Fed.

Commodities

Brent Crude gained 2.36% this week to $98.04 per barrel, despite recession comments from a number of central bankers stoking fears of a reduction in demand. The potential re-opening of the Chinese economy and reduction of Covid-19 restrictions does offer the market some optimism.

The Week Ahead

Monday – China Trade Balance, UK House Price Data

Tuesday – US Mid-Term Elections, EUR Retail Sales

Wednesday – China CPI

Thursday – US CPI and Initial Jobless Claims

Friday – UK GDP

*Price changes as of last week’s close unless stated otherwise.