Jan 6, 2023 3:48:49 PM

Weekly Market Wrap 06/01/2023

Global markets have started the new year with optimism, as investors hope to move on from equities’ dismal performance in 2022. Economic data provided mixed indicators this week, with European inflation data and US jobs data released on Friday. UK house prices continue their decline, whilst the FOMCs latest minutes revealed what investors can expect from the Fed in the coming months. Meanwhile, Chinese stocks received positive news, despite the ongoing COVID situation.

UK Market

The UK market ended the week higher, despite a report from the British Chamber of Commerce, which cited higher energy costs and post-Brexit trade difficulties as a key negative driver for UK businesses in 2023. Data released on Friday showed that UK house prices fell for a fourth consecutive month, dropping 1.5% in December. 14-year high interest rates and the ongoing cost of living crisis appear to be having a significant impact on UK housing demand, with economists predicting price falls of between 10 and 20% in 2023. Strikes continue across the UK, as nurses, paramedics, and rail staff are all involved in demonstrations. Prime Minister Rishi Sunak is set to fast track public sector pay negotiations in a bid to end strikes and avoid further walk outs.

US Markets

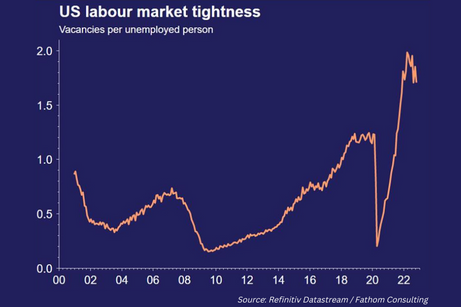

The S&P 500 is currently ending the week flat at 3,845 and the NASDAQ is down 0.89% at 10,373. Minutes from the Federal Reserve’s December meeting were released this week. Minutes showed that the Fed remains committed to bringing inflation back to the target rate and reminded markets that the recent slowdown in the pace of rate increases was not an indicator that the FOMC believes it’s job is nearly done. Minutes also showed that no members expect rate cuts in 2023, despite markets currently pricing in at least one cut before the end of the year. Non-farm payrolls came in higher than expectations on Friday, increasing by 223,000 rather than the estimated 200,000. This data was accompanied by US wage inflation that showed hourly earnings had grown by 0.3% (est 0.4%), supporting the case of peaking inflation.

European Markets

The Euro Stoxx 50 is currently up 3.95% at 3,795, the DAX is 4.13% higher at 14,501 whilst the CAC 40 has gained 5.28% to 6,816. European inflation fell significantly more than expected in December, with CPI falling to 9.2%, well below the 9.7% estimate. Despite headline inflation showing a large downside surprise, core measures revealed that there is still a long way to go in the fight against inflation. CPI excluding food and energy prices rose to 6.9% from 6.6%, whilst a measure also excluding alcohol and tobacco rose to 5.2% from 5%. Retail sales data offered a more positive view, growing by 0.8% rather than the 0.5% estimate. Rising retail sales indicates that consumer demand may recover quicker than anticipated in Europe.

Asian Markets

Chinese headquartered stocks received a boost earlier this week, after the regulator allowed Ant Group to raise additional capital, after a planned IPO in 2020 was not allowed to go ahead. The move increased optimism amongst investors that Chinese regulatory authorities may be beginning to relax their stance towards tech and internet based companies.

Fixed Income

Yields on the US 10-Year fell this week to 3.62%, with lower than expected wage inflation data pushing yields lower. Friday’s data showed average hourly earnings slowing to 0.3% from 0.4% in November, supporting the case that inflation is easing and that large rate hikes are not needed.

Commodities

Brent Crude fell 6.70% this week to $80 per barrel, as ongoing concerns about China’s covid situation and weakening demand pushed oil prices lower.

The Week Ahead

Monday – Japan CPI

Tuesday –

Wednesday – China CPI

Thursday – US CPI & Initial Jobless Claims

Friday – UK GDP, Euro Zone Industrial Production

*Price changes as of last week’s close unless stated otherwise.