Jun 24, 2022 3:27:40 PM

Weekly Market Wrap 24/06/2022

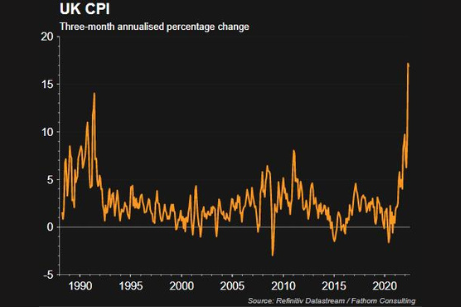

UK Inflation has hit its highest level in 40 years, reaching 9.1% in May 2022, whilst consumer confidence reaches an all-time low for UK households. Further pressure has been placed upon Boris Johnson and the Conservative party after the party failed to win either of the two by–elections which were held this week. Jerome Powell testified to congress on Thursday and reassured government officials that the Fed’s goal was to restore price stability in the US. Ukraine and Moldova have taken its first step towards becoming a member of the EU, whilst the wider European political landscape continues to look shaky after French President Macron failed to achieve a parliamentary majority in the recent election.

US Markets

The S&P 500 is currently ending the week up 4.69% at 3,846 and the NASDAQ is up 6.05% at 11,451. US Markets rose this week as fears that the Federal Reserve would raise rates in such an aggressive manner that economic growth could be dampened were eased by falling commodity prices and reduced business activity. Jerome Powell also reinforced to congress this week that the Fed was committed to fighting inflation and said that a rate increase of 50 or 75 basis points was likely to be required at the next meeting.

UK Market

The UK market avoided a fourth consecutive week of losses, despite inflation data for May of this year showing a 40-year record high of 9.1% and the Bank of England forecasting inflation to peak at more than 10% later this year. Petrol prices were one of the largest contributors to May’s inflation measure. UK consumer confidence has hit an all-time low as increasing inflation and loan repayments (many of which are linked to RPI) cause consumers to view the future for their finances with significant negative sentiment.

UK retail sales showed a drop of 0.5% in May, with data showing that consumers are being forced to reduce the amount of money spent on food due to the increase in cost of living. Further pressure was placed on the government after the two by-election defeats through the RMT workers union strike has left almost half of the UK’s rail network closed, as rail staff take action over pay and the threat of job losses.

European Markets

The Euro Stoxx 50 gained 2.01% to 3,507, the DAX was flat at 13,084 whilst the CAC 40 was up 2.52% to 6,030. European markets gained this week with defensive stocks leading the way as investors sought more stable investments with the likelihood of a recession in Europe growing ever larger. The European Union has granted Ukraine candidate status, in a bid to provide much needed assistance and support to the country currently under invasion by Russia.

Russia may be about to default on foreign debt for the first time since 1998 after sanctions imposed on Russia significantly increased the difficultly to make overseas payments. Investors are required to receive their interest payments by Sunday in order for Russia to avoid triggering a default which would make the process of Russia issuing government debt in the future much more difficult.

Fixed Income

Yields on the US 10-Year Treasury slipped to 3.06% as rate hike expectations for the Fed eased after recent economic growth measures showed reduced levels of activity.

Commodities

Brent Crude fell by 1.30% this week to $111 per barrel, pushed lower by concerns that the global economy could be heading for a recession as central banks look set to continue with rapid interest rate rises. Gold also drifted lower this week, falling 0.90% to $1,822 as further rate hikes by the US Federal Reserve reduce the relative attractiveness of Gold as a non-income yielding asset.

The Week Ahead

Monday – US Durable Goods Orders

Tuesday – US Consumer Confidence

Wednesday – US Housing Price Index

Thursday – UK GDP, US Initial Jobless Claims

Friday – US Manufacturing PMI

*Price changes as of last week’s close unless stated otherwise.