Feb 3, 2023 2:54:56 PM

Weekly Market Wrap 03/02/2023

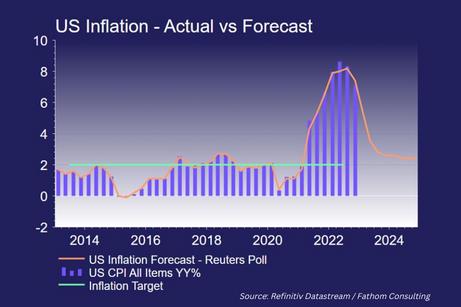

Equity markets finished the month of January on a high and continued to rally into the end of the week. All three major central banks announced their latest interest rate decisions this week, whilst corporate earnings for major US tech companies took centre-stage on Thursday. US Jobs data surprised to the upside, whilst Euro zone inflation data offered a downside surprise, but the underlying data showed that the path to the 2% target may not be an easy one.

UK Market

The UK market ended the week higher, as the Bank of England raised the benchmark interest rate by the expected 0.50% to 4.00%. January PMI data showed that the service sector had its worst month in two years, echoing the Bank of England’s recession warnings. Strikes continued to plague the UK as the International Monetary Fund forecasted the U.K. economy to contract by 0.6% this year vs. previous expectations of slight growth, the only major economy expected to shrink in 2023.

US Markets

The S&P 500 is currently ending the week up 1.65% at 4,138 and the NASDAQ is up 3.43% at 12,583. The US Federal Reserve raised interest rates by 25bps as expected this week, however Fed Chairman Jerome Powell’s speech was seen by the market as being particularly dovish. Powell acknowledged that disinflation has begun within the US, but reinforced that the Fed expects further interest rate hikes in the coming meetings and also told the press conference “I just don’t see us cutting rates this year”. Markets largely ignored Powell’s comments, with just one further hike expected and at least one rate cut still priced in for 2023. US Non-farm payrolls provided a large upside surprise on Friday, adding 517,000 jobs (est 185,000), showing that the US economy remains strong, increasing the likelihood that rates could rise to the 5.00% level. The news sent US futures lower before market open on Friday.

European Markets

The Euro Stoxx 50 is currently up 0.88% at 4,215, the DAX is 1.55% higher at 15,387 whilst the CAC 40 has gained 0.81% to 7,155. Euro zone inflation fell for a third consecutive month in January, falling to 8.5% from 9.2% in December. Whilst the data was significantly lower than the economist consensus of 9.0%, inflation excluding fuel and food prices rose to 7.0% from 6.9%. This reinforced the European Central Banks’s stance that further rate hikes are needed to bring inflation back towards the 2% target. Thursday saw the ECB announce its latest rate move, increasing the base rate to 3.00% from 2.50%.

Fixed Income

Yields on the US 10-Year were flat this week at 3.50%, boosted slightly on Friday after a higher than expected non-farm payrolls figure pushed rate expectations higher.

Commodities

Brent Crude dropped 4.72% this week to $82 per barrel, falling due to a lack of any clear sign that Chinese demand is set to recover.

The Week Ahead

Monday – European Retail Sales

Tuesday – Australia Interest Rate Decision

Wednesday –

Thursday – US Initial Jobless Claims

Friday – UK GDP, China CPI

*Price changes as of last week’s close unless stated otherwise.